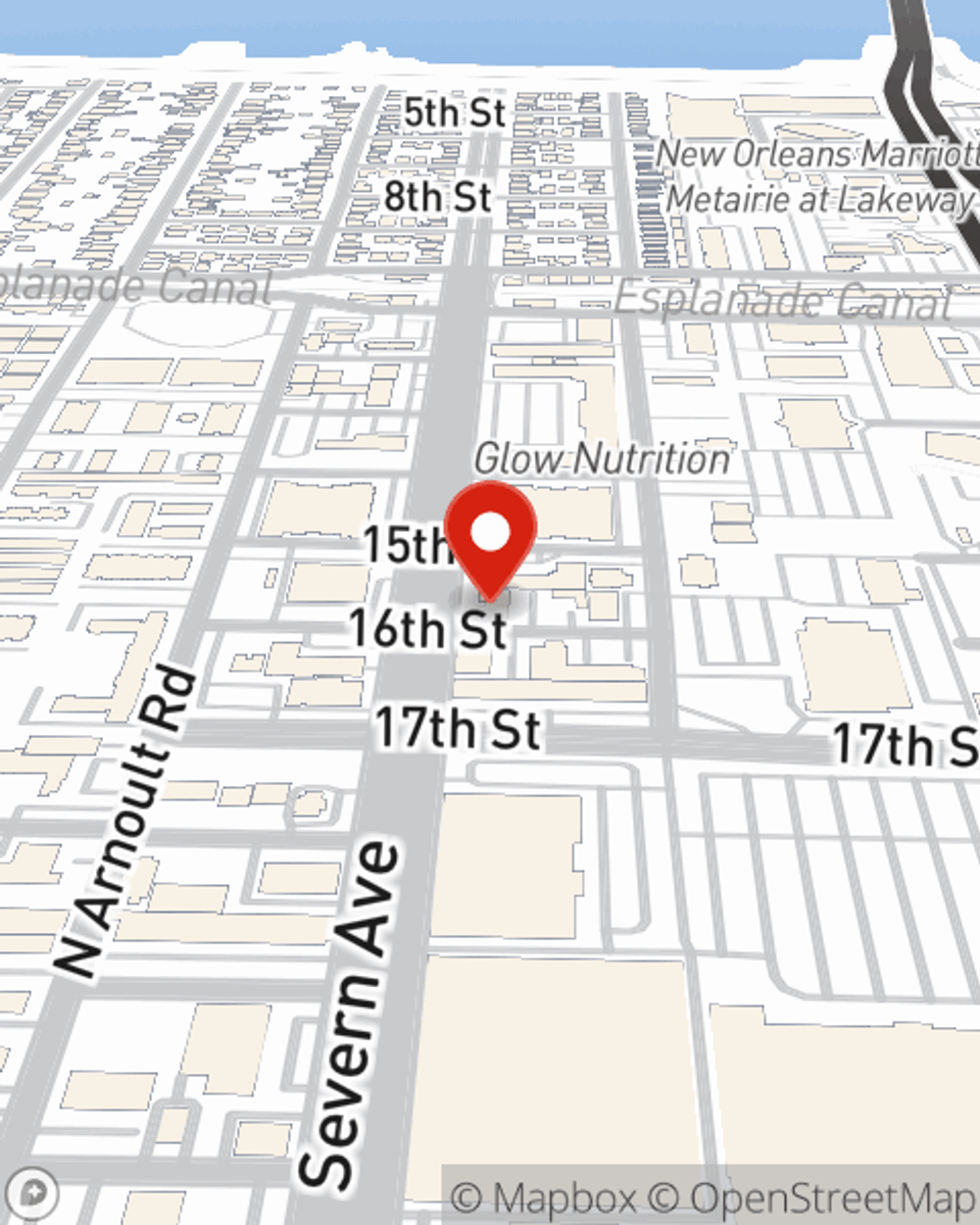

Business Insurance in and around Metairie

Metairie! Look no further for small business insurance.

Insure your business, intentionally

Help Protect Your Business With State Farm.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes catastrophes like a customer stumbling and falling can happen on your business's property.

Metairie! Look no further for small business insurance.

Insure your business, intentionally

Protect Your Business With State Farm

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like errors and omissions liability or a surety or fidelity bond, that can be designed to develop a personalized policy to fit your small business's needs. And when the unexpected does happen, agent Barbara Malter can also help you file your claim.

Don’t let fears about your business stress you out! Call or email State Farm agent Barbara Malter today, and learn more about the advantages of State Farm small business insurance.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Barbara Malter

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.